inheritance tax calculator colorado

Cost of living comparison calculator. Our network attorneys have an average customer rating of 48 out of 5 stars.

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

Long-term capital gains are when you hold an investment for more than a year after purchased.

. If you make 70000 a year living in the region of Colorado USA you will be taxed 11001. Capital gains tax is the tax paid on profits you make from selling an investment for more than it was purchased for. The gas tax in Colorado is 22 cents per gallon of regular gas one of the lowest rates in the US.

There is no estate or inheritance tax in Colorado. Colorado Capital Gains Tax. Your average tax rate is 1198 and your marginal tax rate is 22.

About a third of all states allow their counties municipalities and other local jurisdictions to impose an income tax. Only five cities in Colorado impose the tax while Kansas has 484 taxing jurisdictions. Not all states have a local tax in every jurisdiction.

Colorado requires that an individual survive a decedent by at least 120 hours or five days in order to become a valid heir under intestate succession law. Short-term capital gains are when you buy an investment and sell it in a year or less. Get the right guidance with an attorney by your side.

Use our income tax calculator to find out what your take home pay will be in Florida for the tax year. Tax rates are often lower than at the federal or state levels. If this prerequisite is not met the estate is distributed as if the possible heir had predeceased the decedent according to Colorado.

Refusing an inheritance isnt complicated but you must be sure youre making the right decision and also following proper procedure. A permanent reduction of Colorados flat individual and corporate income tax rates changed it from 463 to 455. This marginal tax rate means that.

The Hall Tax was completely phased out. Other Situations in Colorado Inheritance Law. And Florida doesnt have an estate or inheritance tax.

And also at some state levels as an inheritance tax. To qualify for the HR Block Maximum Refund Guarantee the refund claim must be made during the calendar year in which the return was prepared and the larger refund or smaller tax liability must not be due to incomplete inaccurate or inconsistent information supplied by you positions taken by you your choice not to claim a deduction or. North Carolina 1000.

Short-term capital gains are treated as income and are taxed at your marginal. May 02 2022 2 min read Can Estranged Relatives Contest Your Will After You Pass Away. New York 2000.

The top marginal individual income tax rate was permanently increased from 49 to 59 with the addition of a new bracket.

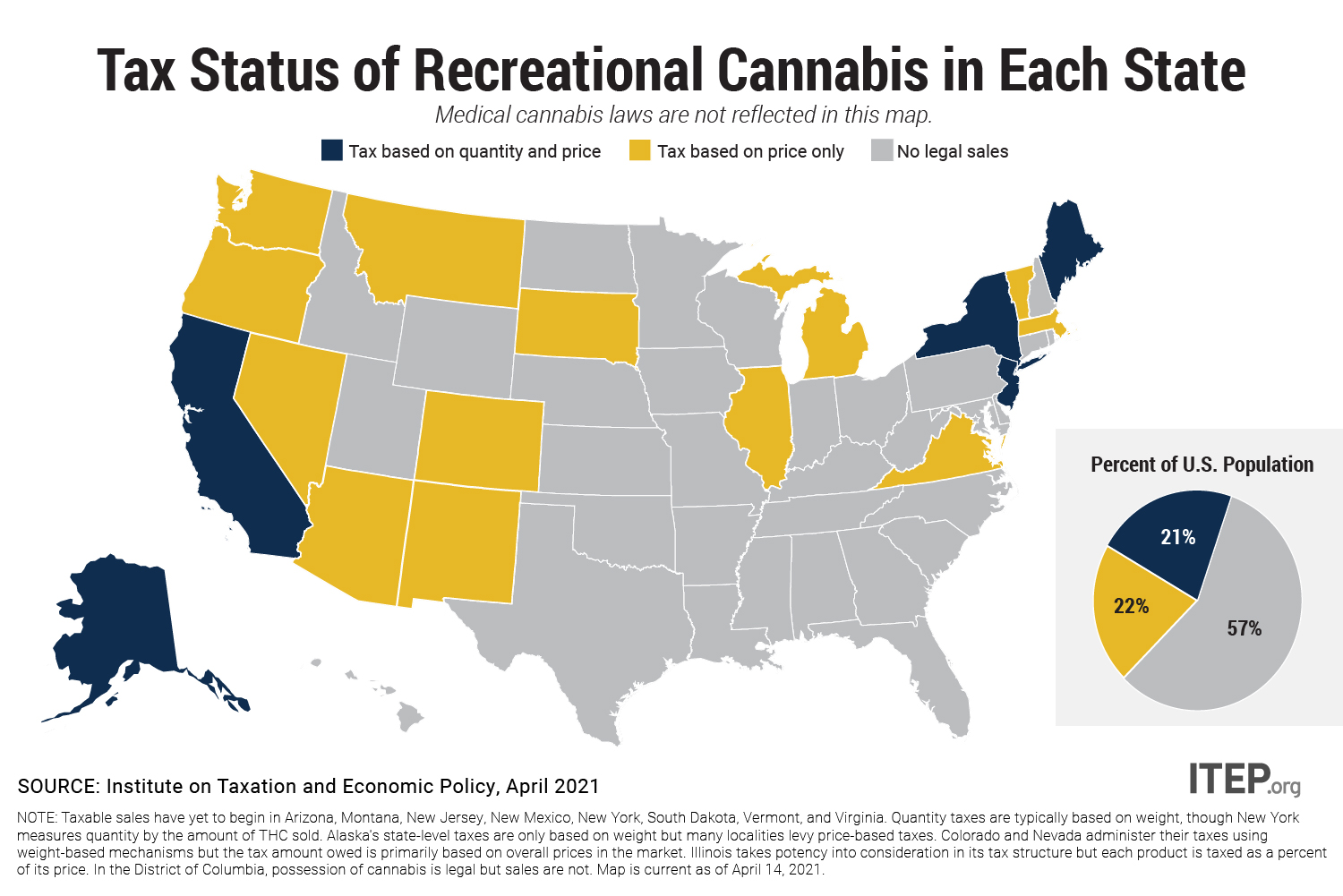

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

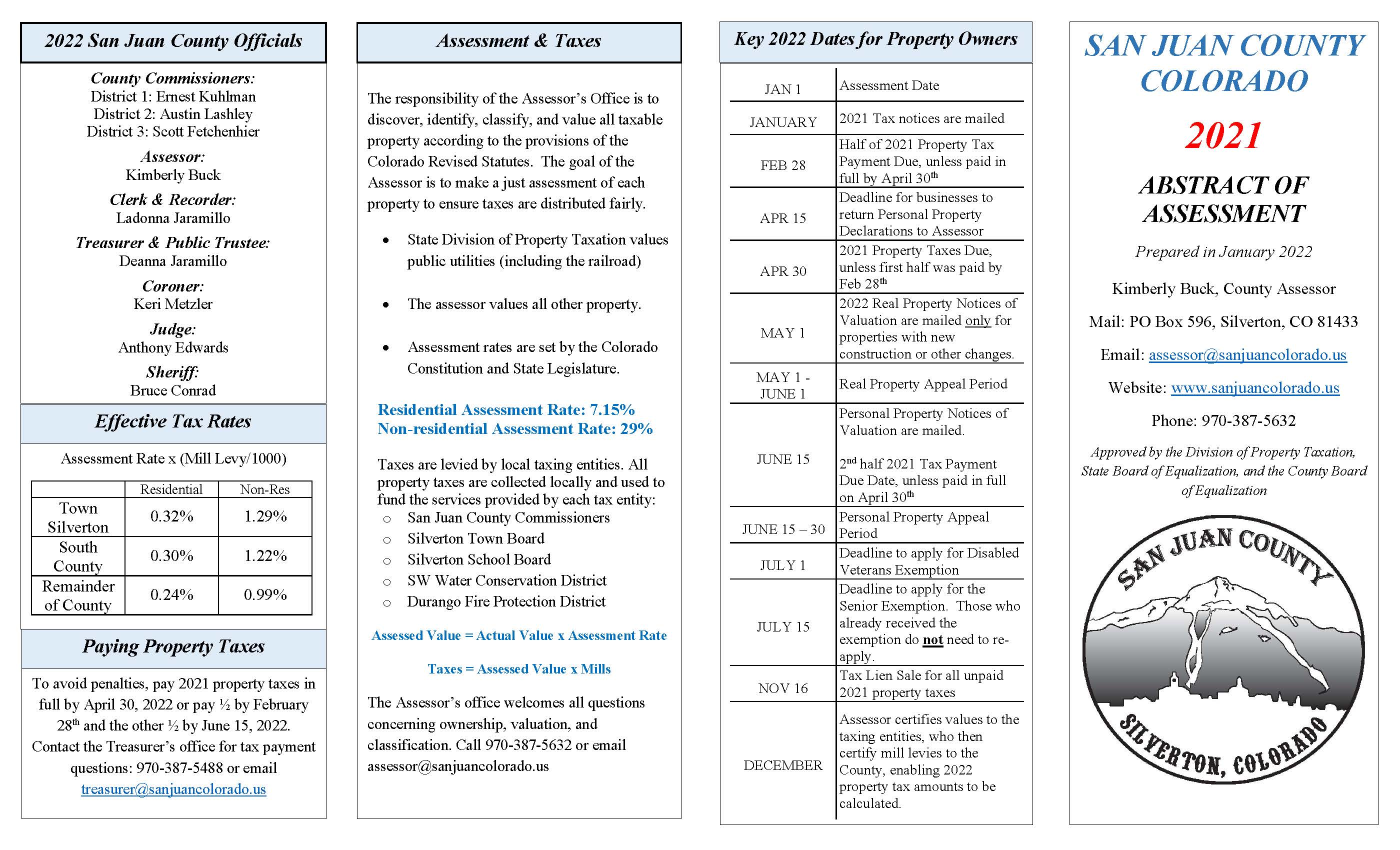

Calculating Property Taxes San Juan County

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Colorado Estate Tax Everything You Need To Know Smartasset

Inheritance Tax Here S Who Pays And In Which States Bankrate

Free Estate Size Worksheet And Tax Calculator Married Free To Print Save Download

Don T Die In Nebraska How The County Inheritance Tax Works

Colorado Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

30 Things You Never Thought You D Miss After Leaving Colorado Stemless Wine Glass Real Estate News Colorado

Can You Appeal A Property Tax Assessment What To Do When You Think Your Bill Is Too High Real Estate Fun Real Estate Tips Real Estate Trends

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2022 Property Taxes By State Report Propertyshark

Next Chapter Property Solutions Can Buy Your House In The Situation When You Want To Sell Your House For Some Reasons We Buy Houses Sale House Reverse Mortgage